by Taylor Damonte, Ph.D., director of the Clay Brittain Jr. Center for Resort Tourism, and Robert Salvino, director, Grant Center for Real Estate and Economic Development, E. Craig Wall Sr. College of Business Administration, Coastal Carolina University

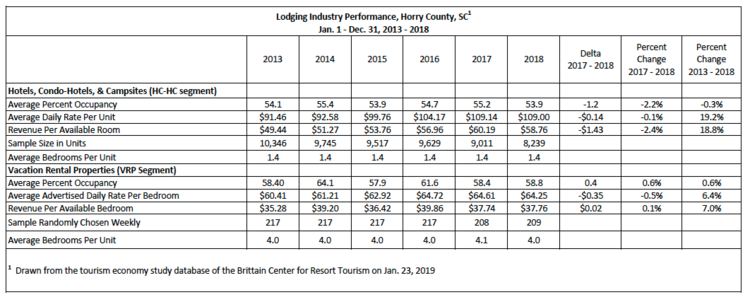

Annual research results for the Brittain Center’s voluntary sample of hotel, condo-hotel, and campsites (HC-HCs) in the Myrtle Beach area are reported in the table below, along with the results of the Center’s scientifically random sample of weekly-rented vacation rental properties (VRPs), during the most recent six years.

Average percent occupancy (APO) for the nightly-rented hotels, condo-hotels, and campsites (HC-HCs) declined by 1.2 occupancy points or 2.2 percent in 2018 compared with 2017. Average daily rate (ADR) for this combined industry segment declined by 0.1 percent compared with 2017. The monthly performance results for April 2018, reported online at the 2019 February CVB Insider Economic Numbers are reflective of a year in which Easter weekend occurred in March instead of April, as it had the year before. The industry seemed to stage a relatively strong rebound during the summer months. In September, Hurricane Florence effectively ended and erased a four-month run of year-over-year gains in APO, and the relatively weaker performance continued in its aftermath throughout the fall. Based on the Center’s scientific random sample of weekly-rented VRPs available to rent in Horry County, VRPs managed to hold on to a gain in average percent occupancy of 0.4 occupancy point or 0.6 percent compared with 2017. However, the average advertised daily rate for the VRP segment declined by 0.5 percent, which would lead to an increase of 0.1 percent in revenue per available unit.

Readers may be interested to know how the Center’s lodging industry samples are compiled and tracked. A voluntary sample of HC-HC properties record and submit their daily operating results to the researchers each week. The HC-HC segment includes three types of properties: condo-hotels, most with no national branding and relatively little convention space; hotels, some brand-affiliated and some independent, some with and some without convention space; and resort-style campsites. Business performance for weekly-rented vacation rental homes and condominium properties (VRPs) is estimated by researchers observing reservations websites for a random sample of properties each week. Researchers assume that if a property is reserved a few days in advance of the scheduled guest check-in date then the property will in fact be occupied for that rental week, unless of course an evacuation order is announced, which was the case during almost the entire second week of September, 2018. A flood watch continued in parts of Horry County for nearly three weeks in the aftermath of the storm.

There is always much variability in performance within the area-wide sub-groupings for which performance is reported below. Participants in the Centers’ study are able to monitor performance results for the hotel segment separately from the condo-hotel segment online. If you represent a hotel or condo-hotel management company and would like to become a participant in the Center’s research and receive segment-level results and six-week occupancy forecasts, please contact Taylor Damonte at tdamonte@coastal.edu at Coastal Carolina University.